Introduction

Welcome viewers to our weekly news updates. Today's article discusses the findings of the Federal Reserve of Dallas on US housing prices.

US Housing Bubble

- Researchers & economists at the Federal Reserve of Dallas have raised concerns about US housing prices that have swayed away from their fundamentals.

- Abnormality in the US market behaviour has pointed to signs of a housing bubble. However, any indication on whether it would pop has yet to be argued.

- Researchers at the Fed have indicated a difference in the housing boom today vs the 2007 bubble burst. If it were to happen, the crash would not be comparable in magnitude or macroeconomic gravity to 2007.

- The household balance sheets have appeared to be better, and excessive borrowing does not seem to be attributed to the housing market boom. Researchers today are experienced and well equipped with advanced tools for early detection and deployment of warning indicators.

- Banks, regulators, policymakers, and market participants can assess real-time data on the housing boom.

Causation of a Bubble

- Researchers believe that the bubble's cause is the price-to-rent ratios and price-to-income ratios. When applying the indicators, the 2021 housing prices appear to step out of fundamentals exponentially. Low-interest rates may play a role in rising housing prices, but it merely represents a part of the housing market trends.

- Several drivers, such as the US Fiscal Stimulus programs and Covid-19 supply chain disruptions and associated policy responses, contribute to the trend changes.

Russia & Ukraine

- Russia & Ukraine's delegations wrap up their discussion in Istanbul. As a sign of trust, Moscow has indicated a reduction in force on its offensive operations near Kyiv and Chernihiv.

- Kyiv has offered neutrality in exchange for security guarantees, proposals on resolving the dispute over Crimeria within 15 years of "bilateral negotiations."

- Russia indicates a scale down in its military operations does not mean a ceasefire.

- Further discussions between Russia and Ukraine will take place Friday (1st April 2022).

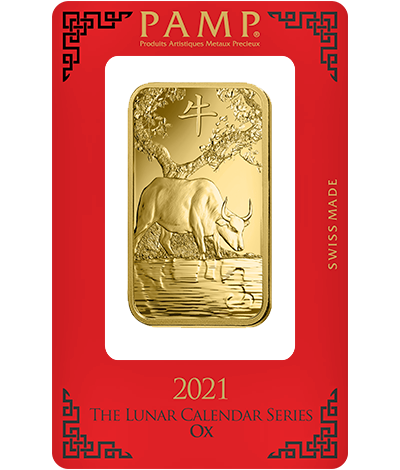

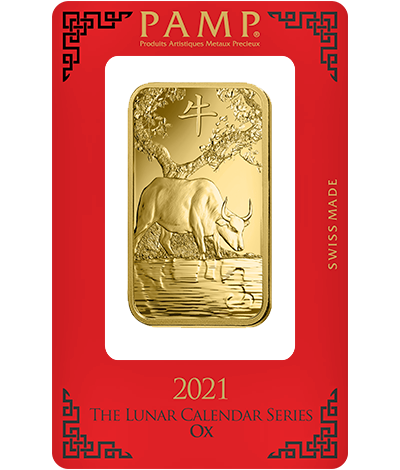

Gold Prices

- Gold has bounced back from $1,920/ounce to $1,940/ounce as the lack of progress between Russia & Ukraine has impeded confidence in the markets.

- Additional investors have flocked to safe-haven currencies and assets such as the US dollar and gold.

- Energy tensions between EU nations and Russia have worsened as the progression of peace talks has yet to further. If Friday's discussions between Russia and Ukraine do not yield, gold prices may return to $1,960/ounce.

Source

ABC News

Al-Jazeera

Deseret

FX Street

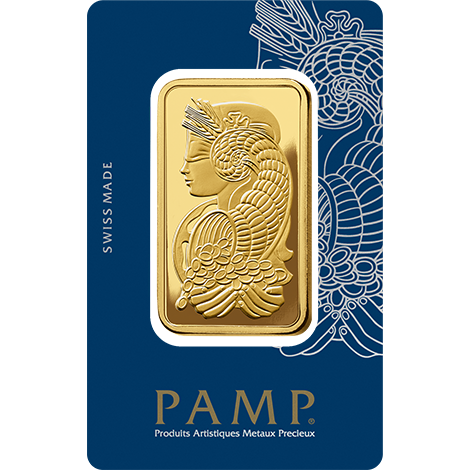

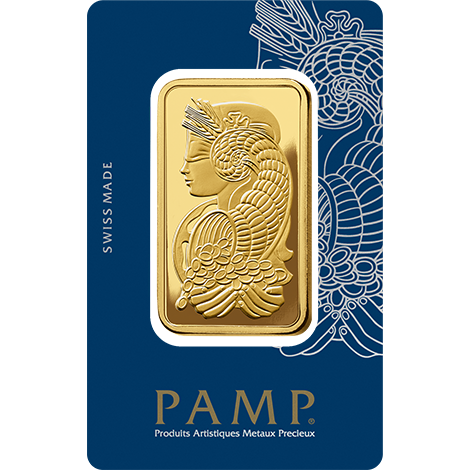

Weekly Gold Investment Series Guide

Checkout our blog weekly or subscribe to our newsletter for the latest Gold Investment Guides

Click here to visit our Blog

Click here to Subscribe to our Newsletter