Introduction

Welcome back to our Gold investment series. Last week, we spoke about investors' common questions before investing in gold. Some of the items covered include understanding your risk profile, time horizon, and the impact of inflation on gold. If you have yet to read part 1 of our article click here.

In part two of our series this week, we will dive deeper into gold products, types of products, sizes, design, and liquidity. Let us begin by looking at the distinct types of products available. We will only be covering minted & cast bars and gold coins. Our next episode will cover non-physical products such as (GAP) Gold Accumulation plans and (ETFs) Exchange Traded Funds.

Cast Bars

What is a cast bar? A cast bar is the classic form of gold bar, the ones that you see in a James Bond movie. On a shorter note, it is a bar that contains a refiner's hallmark, weight, purity, and serial number. For your reference, we have included some samples below.

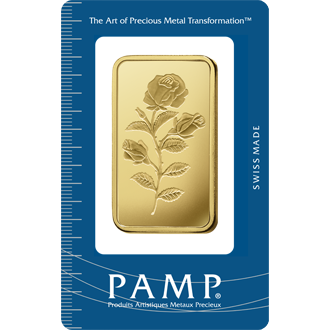

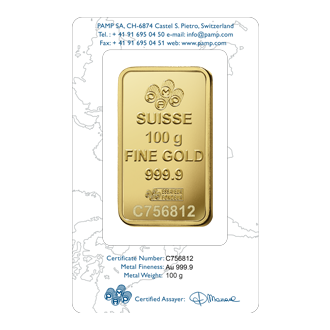

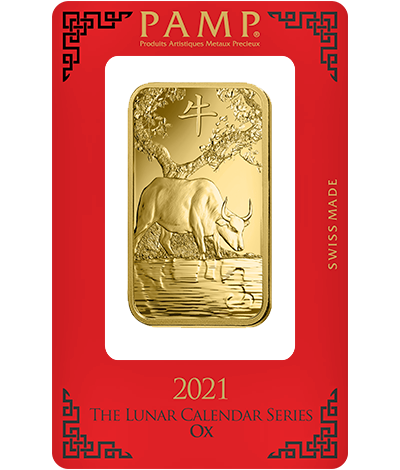

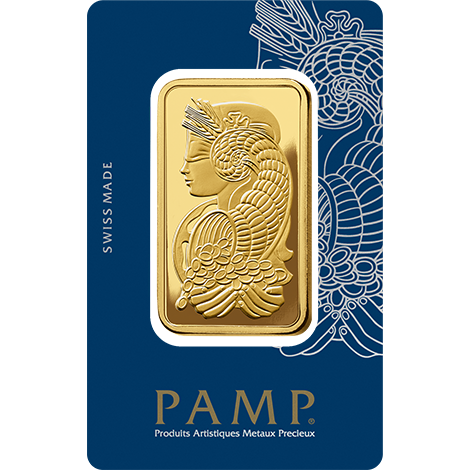

Minted Bars

The counterpart of cast bars is the minted bars. Minted bars are another form of gold that differs from cast bars in size, pricing, packaging and design. Like the ones you see below, each minted bar is unique in its way. It is similar to the cast bar except for the design, sizes and packaging.

Bullion Coins

Apart from the cast and minted bars, investors have the option of gold coins. Gold coins are traditionally denominated in one troy ounce size (31.10 grams). Highly prevalent in the United States and Europe, gold coins have also extended their presence in (SEA) Southeast Asia.

What are some of the benefits and drawbacks of each type of product?

Sizing

- Cast bars: 50 grams to 1 kilogram

- Minted bars: 1 gram to 100 grams

- Bullion coins: Usually 1 Troy Ounce (31.10 grams)

Note: Understanding the different sizes available will help determine what sizes will suit your investment needs. Some investors may prefer to invest in high volume, small sizes for easy liquidity, while others prefer larger sizes but smaller volumes.

Price & Design

When we determine the cost of the products, we like to refer to the “premium”.

Premium - "The excess charged by a precious metals dealer over the intrinsic value of gold for physical delivery".

The premium for "Cast Bars" are much lower when compared to minted bars and bullion coins. The manufacturing costs of cast bars are inexpensive due to their uncomplicated design and unprecedented demand by various industry sectors (Retailers, Investors, and jewellery manufacturers).

However, the accuracy and additional design requirements make it tedious and expensive to produce when it comes to minted bars. The cost of production of a 10-gram bar versus a 100-gram bar is almost similar. If we were to consider a scale perspective, a refiner or trader would stand to benefit from the sale of a larger size bar versus a smaller size bar.

Bullion coins, however, differ in premium from refiner to refiner. The Austrian and Canadian Mint may command a higher premium than Royal UK Mint and American Mint. However, compared to minted and cast bars, the coins, on average, do command a higher premium, especially in the US.

Liquidity

Are each product different from the other on the note of liquidity, and does one command more liquidity? Generally, it depends on several factors:

- Size: The larger sizes tend to be slightly more difficult to liquidate as most goldsmith stores tend

- Proof of Purchase: Investors that have long invested or have lost their receipt may be required to produce some verification. Otherwise, an investor might risk commanding a lower price for their gold.

- Brand: Global brands versus local brands. The reason why some brands command higher premiums is due to their recognition, whether locally or globally. Global brands tend to be easier to liquidate as they have better recognition and trustworthiness.

- Method of payment: The choice of cash, cheque or bank transfer. Each payment method may command a different price point as some retailers may command higher charges for bank transfers and cheques.

- Product Type: Most of the time, when one sells used gold, the product gets scrapped (melted).

Storage

When investing in physical gold, the most common question is, “Where will I store it” or “do you offer storage facilities”. The size factor comes into play as smaller sizes, such as the 100 grams bars, are easy to store and fit perfectly in books or small compartments. However, when it comes to ½ kilogram or 1kilogram (similar size to an iPhone 6), it becomes a bit more complicated to store. Generally, most investors would prefer to hold it in a safety deposit box.

Stay tuned for next week's article on non-physical gold investments and our verdict on gold investment

Weekly Gold Investment Series Guide

Checkout our blog weekly or subscribe to our newsletter for the latest Gold Investment Guides

[…] Common Questions on Gold Part 1Common Questions on Gold Part 2 […]